|

Here are some excellent resources on debt and interest, and the specific issue of the debt ceiling (also known as “debt subject to limit”).

The US Treasury Department has these graphics that show Debt to the Penny, charts that show Public Debt Outstanding and Debt Subject to Limit of $14.294 billion and an FAQ page that explains the difference between those two groups and other debt related issues.

In December, the Congressional Budget Office released a primer on all things related to federal debt and interest costs. This report emphasizes “debt held by the public” in that report, but includes debt subject to limit beginning near the bottom of page 21 of the report.

In February, The Governmental Accountability Office released titled: "Debt Limit: Delays Create Debt Management Challenges and Increase Uncertainty in the Treasury Market," and also has these resources dedicated to debt and deficits.

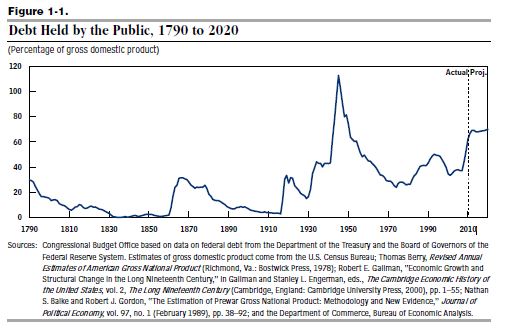

From the Congressional Budget Office Report: Federal Debt and Interest Costs, December 2010

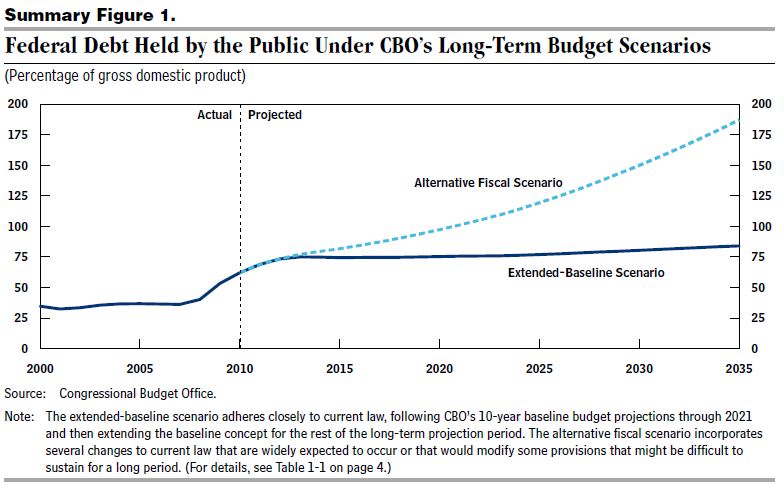

From the Congressional Budget Office: 2011 Long-Term Budget Outlook, June 2011

|

|

AABPA member Thad Juszczak wrote a helpful white paper on the issue.

Introduction

The Federal budget deficit and resulting debt have generated much attention lately, with threats of a government shutdown and dueling proposals from the Democrats and Republicans for a 2012 budget.[i] The budget deficit is the amount by which Federal outlays (cash or equivalents) exceed revenues for a particular year. Debt is the amount of cash borrowed (primarily from sources outside of the Federal government) to cover the cumulative net amount of all the deficits (and a few surpluses) incurred. The 2009 Federal deficit exceeded $1 trillion (T) for the first time, and it is expected to stay over $1 T each year through 2012. The President’s 2012 Budget estimates that total Federal debt will rise to $25 T by 2020, a 280% increase from the 2008 Federal debt level.

Congress uses a Debt Limit to regulate government borrowing, but actual borrowing is handled by the Treasury Department. This Debt Limit does not constrain the ability of Congress to authorize spending through appropriations or other statues, but it does limit the ability of the Treasury Department to borrow funds and ultimately to pay (i.e., issue cash or equivalents) for spending already authorized and executed.

The Debt Limit is not well understood by many Americans. Recent polls have indicated that 62% of Americans oppose an increase in the Debt Limit, probably because they are concerned about deficit spending. As you will see in this paper, the Debt Limit can be a confusing concept. However, the key point is that the Debt Limit does not affect how much Congress authorizes to be spent. That is done through appropriations and other legislation. Because many Americans do not understand the Debt Limit, politicians in both parties could be concerned that voting for a Debt Limit increase would be portrayed (especially by their political opponents) as encouraging deficit spending.

Much of the spending authorized by Congress in one year is not paid out until future years. Therefore, borrowing (and Debt Limit changes) may not be required until future years for the spending authorized this year. The Debt Limit covers most government payments; it can affect the Treasury Department’s ability to issue checks and other cash equivalents to pay federal employee and military salaries, contractors’ invoices, as well as social security benefits and Medicare bills.

Because Debt Limit legislation is “must pass” legislation, it represents a political opportunity. Each time the Debt Limit must be increased, both Democrats and Republicans typically use the occasion to focus on related (or unrelated) issues. Total Federal debt met the current Debt Limit in May 2011, but the Treasury Department was able to manage certain investments in a way that would extend the limit until early August 2011. Legislation to increase the Debt Limit must pass by then. Republicans have indicated that they will not support an increase in the Debt Limit unless Democrats agree to significant budget reductions for 2012 and beyond. These budget reductions will impact the Debt Limit some day, but they are not actually relevant to the currently required increase.

News stories about the Debt Limit often discuss the potential economic havoc that could be caused by the government defaulting on its loans, even though the amount of revenue the government collects would easily be sufficient to pay interest to its investors. The problem is that the government does not currently have enough revenue to pay creditors and to pay for current operations, including social security, Medicare, and retiree benefits, a point that is rarely discussed. The only way the government can renege on its debt is by deliberately choosing not to use its revenues to pay its investors.

This paper examines some of the details behind the Debt Limit to allow the reader to better understand the mechanics of the Limit and its political impact.

Open the full PDF

|